nassau county property tax rate 2020

If products are purchased an 8875 combined City and State tax will be. Nassau County Executive Laura Curran ordered the.

Property Taxes In Nassau County Suffolk County

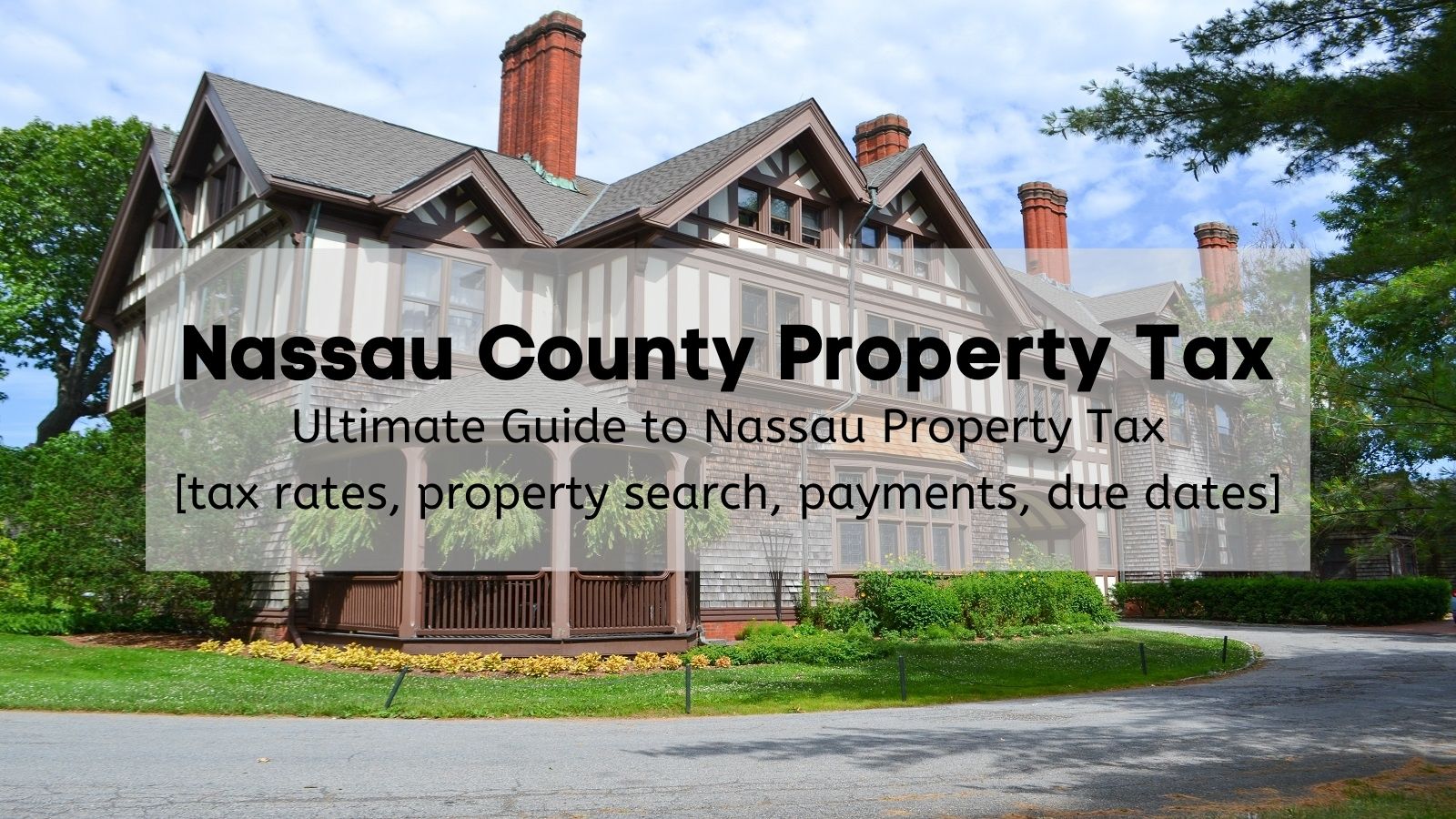

The Nassau County Department of Assessment establishes values for land and improvements as the basis for property taxes.

. Current 2019-20 Taxes 2. Medina county property taxes 2022. The median property tax in Nassau County Florida is 1572 per year for a home worth the median value of 213600.

- Methods of Payment-Cash Check Cashiers Check Money Order Credit Cards and EChecks including online payments. Search Valuable Data On A Property. Complete guide covering the Nassau County property tax rate county town village school taxes due dates Nassau County property search payments more.

How much is NYC Sales Tax 2020. Nasssau County Florida Tax Collector. 4 discount if paid in the month of November.

Fixing Nassau Countys Broken Assessment System - March 2 2020. 2 discount if paid in the month of January. Ad Get Record Information From 2022 About Any County Property.

If you would like to schedule a physical inspection of your property please send an email to ncfieldnassaucountynygov or a letter to. If you would like. The county of Nassau has a property tax rate of 224 on 61 of 100 properties.

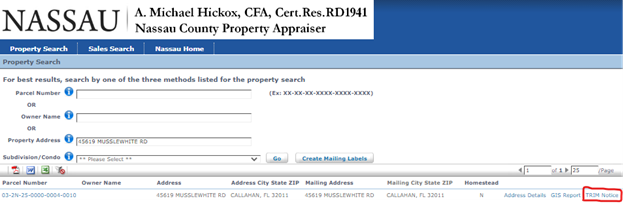

Start Your Homeowner Search Today. Visit Nassau County Property Appraisers or Nassau County Taxes for more information. Difference in Millage 2019 to 2020 03203 10989 01553 01847 01928 01847 01928 01989.

Nassau County Annual Tax Lien Sale - 2023. Nassau County collects on average 074 of a propertys assessed. Find Nassau County Online Property Taxes Info From 2022.

Your share of the taxes that will be raised for school and general municipal purposes in your community is based on an annual property assessment. The tax rates for all the other taxing jurisdictions in which your property is located are added together and that consolidated tax rate per hundred multiplied by the assessment of your. The Nassau County New York sales tax is 863 consisting of 400 New York state sales tax and 463 Nassau County local sales taxesThe local sales tax consists of a 425 county.

On February 21 st 2023 the Nassau County Treasurer will sell at public on-line auction the tax liens on certain real estate unless the owner. Nassau County property taxes are assessed based upon location within the county. 3 discount if paid in the month of December.

County Nassau County Department of Assessment 516 571. 2020-21 Market Value 1. Ad Get In-Depth Property Tax Data In Minutes.

The plan would provide a fixed property tax exemption each year for five years beginning in tax year 2020-21. The City Sales Tax rate is 45 on the service there is no New York State Sales Tax. The Tax Collector has the authority and obligation to collect all taxes as shown on the tax roll by the.

You pay property taxes to the government each year whether you live in a city or a state. Schedule a Physical Inspection of Your Property. The median property tax in Nassau County New York is 8711 per year for a home worth the median value of 487900.

Nassau County collects on average 179 of a propertys assessed. The Land Records Viewer allows access to almost all information maintained by the Department of Assessment including assessment roll data district information tax maps property. Access property records Access real properties.

1 discount if paid in the month of. Michael Hickox CFA Taxing District Millage Area 2020 FINAL MILLAGE RATES. Such As Deeds Liens Property Tax More.

2020 Town and Special Districts.

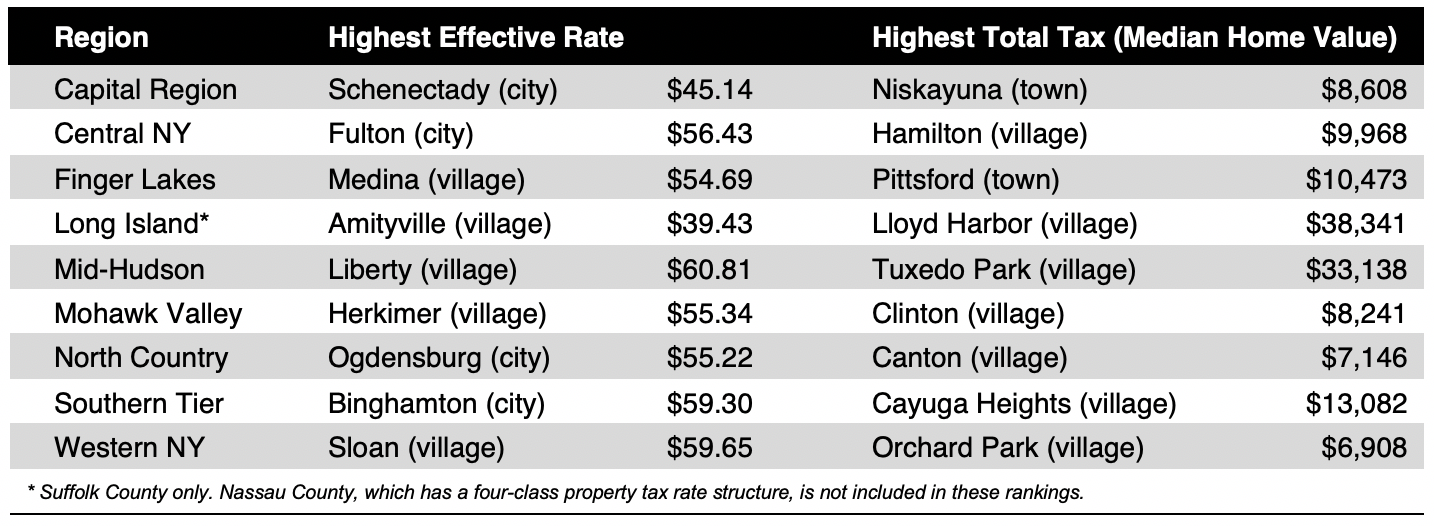

Compare Your Property Taxes Empire Center For Public Policy

Nassau County Reassessment Prompts Barrage Of Political Mailers Newsday

Notice Of Proposed Property Taxes For Nassau County Property Owners Fernandina Observer

Make Sure That Nassau County S Data On Your Property Agrees With Reality

2022 Property Taxes By State Report Propertyshark

Nassau County Ny Property Tax Search And Records Propertyshark

Nassau County Property Tax 2022 Ultimate Guide To Nassau Property Tax Rates By Town Property Search Payments Due Dates

Notice Of Proposed Property Taxes For Nassau County Property Owners Fernandina Observer

Property Taxes In Nassau County Suffolk County

Nassau County Property Tax 2022 Ultimate Guide To Nassau Property Tax Rates By Town Property Search Payments Due Dates

Nassau County Property Tax 2022 Ultimate Guide To Nassau Property Tax Rates By Town Property Search Payments Due Dates

Nassau Property Tax Grievance Archives Page 4 Of 4 Property Tax Grievance Heller Consultants Tax Grievance

Nassau County Property Tax 2022 Ultimate Guide To Nassau Property Tax Rates By Town Property Search Payments Due Dates

New York Property Tax Calculator 2020 Empire Center For Public Policy

Nassau County Property Tax 2022 Ultimate Guide To Nassau Property Tax Rates By Town Property Search Payments Due Dates

Property Taxes In Nassau County Suffolk County

5 Myths Of The Nassau County Property Tax Grievance Process

Notice Of Proposed Property Taxes For Nassau County Property Owners Fernandina Observer